ATC

ATC

Salary – start another employment

Entrepreneurship – start a new business

Investments

Pension

Insurance annuity

Your retirement may have been sudden, unplanned or unfunded. Even when planned, the prospective income may not be able to meet even your fixed expenses. At this point, we must consider alternative sources of income. What alternative sources of income

One way of getting alternative income is by starting a business.

Depending on your age and physical characteristics at retirement, you may seek new employment on a part-time or full-time basis to supplement your retirement income.

Prepare a resume stating your experiences, Skills and also acquire necessary training needed for a particular job field.

Suitable jobs and sources of income for retirees

Teaching – Use your skill and knowledge to help younger people

Consulting – Apply your experience to improve other people’s businesses

Online work – call center or online work

Retail jobs

Work for a nonprofit

Rent your home as office space

INVESTMENT MANAGEMENT

Managing your investment portfolio is a process of selecting products that will address your objectives and generate adequate income in the short/medium term too.

Various strategies could assist in filling out your income from investment portfolio, with products generally falling into one or more of these categories based on their primary characteristics.

Growth

Fixed income

Insured

Liquid

Miscellaneous

Derivatives

Growth: investments which historically have greater return potential, though usually higher risk such as shares. However these could also be volatile with violent swings either way.

Fixed - investments and products, such as T-bills, bonds, and pension payments, provide fixed, stable income and returns overall, but they can be subject to some risks. Overall, these products and sources are good for coverage of fixed expenses.

Insured - the primary characteristic is an insurance component that provides some form of guarantee. These types of financial products include annuities, life insurance, and long-term care insurance.

Liquid - These products, such as certificates of deposit, Treasury bills, etc. Provide easy and quick access to your assets, have lower risks and returns. Traditionally used for emergency funding.

Miscellaneous – wide range of products. Provide income, growth potential or wealth transfer potential. Includes real estate; products such as trusts, etc. which contain assets similar to those in the other four categories.

For each of the five retirement challenges — changing sources of income, longevity and making your money last, inflation, market volatility and rising healthcare costs—several solutions generally exist, allowing you to choose one based on your individual goals and profile. In addition to ensuring that these products and strategies are suitable, you should consider how they work together to provide the best possible mix for your overall portfolio.

Investment Strategy and Management

Successful investing for the long term has always been an outcome of the following key principles, elements and a clear strategy. Below, we outline a suggested path to successful investing:

First steps:

Why invest? This is the first question from which all else follows. You are usually investing for one of the following reasons.

You want to make (more) money

You want to have “reserve” that grows with time

You are preparing for the day when you will no longer be earning a regular salary and are close to retirement. Therefore you want an income from investments. When you’ve answered this question then you need to consider the next questions;

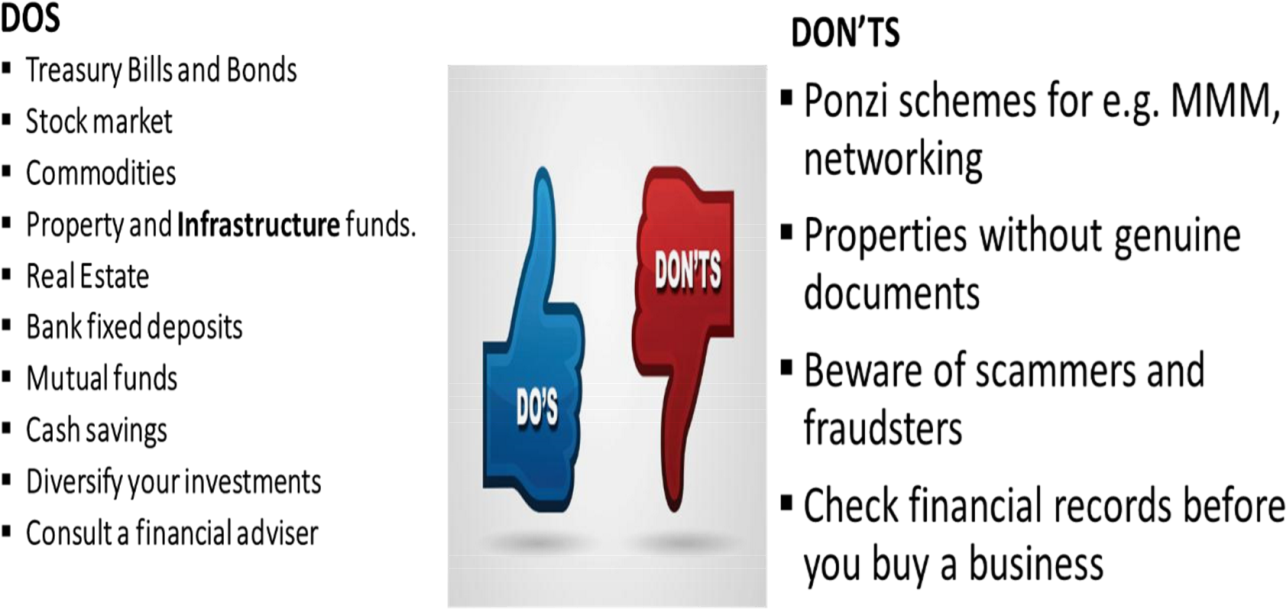

What to invest in? The choices here are almost infinite as experts continue to create all manner of investment assets from the most basic to the most complicated and imaginative. However, the basic choices revolve around Cash, Bank Deposits, Fixed Income Securities (Treasury Bills, Bonds), Mutual funds, Unit trusts, Equity, Property, Derivatives, Commodities, Alternative investments etc. Your choice will largely depend on the reasons for investing as stated above. These options all result in different outcomes and have different time horizons. One key element to adhere to here is “Diversification”.

The next question is the How? How do you invest? You can invest directly or through an Investment Bank, Asset manager, Fund or other vehicle. These options too have implications for your earnings, tax and other elements.

Principles of Investment

Assess your risk appetite

Diversify your investments

Get your timing right

Start investing early and reinvest your gains whenever possible

Regularly review your portfolio

Other considerations involve Safety, Tax, and your own investment philosophy; Are you a conservative or moderately aggressive investor? Are you a gambler? These all play a part in determining where you eventually end up.

When you put all these together, you ultimately end up with an “Investment Strategy” and therefore an “Investment Portfolio” which should then meet your objectives.

Please note that it’s a good idea to use an adviser wherever and whenever possible.

We leave you with a few notable quotes from a variety of renowned experts amongst others;

“Failing to Plan is Planning to Fail”

“There’s no gain without pain”

“You have to speculate to accumulate”

“Patience is your pal”

“Greed is the accelerator”

“Fear is the break”

Need For Investments

Investing your pension in retirement means balancing income with growth

Pension savings now have to last two decades, so you need to work harder(assumption from age of retirement 50, then to 70years)

Pick the right investments now or you run the risk of running out of cash