ATC

ATC

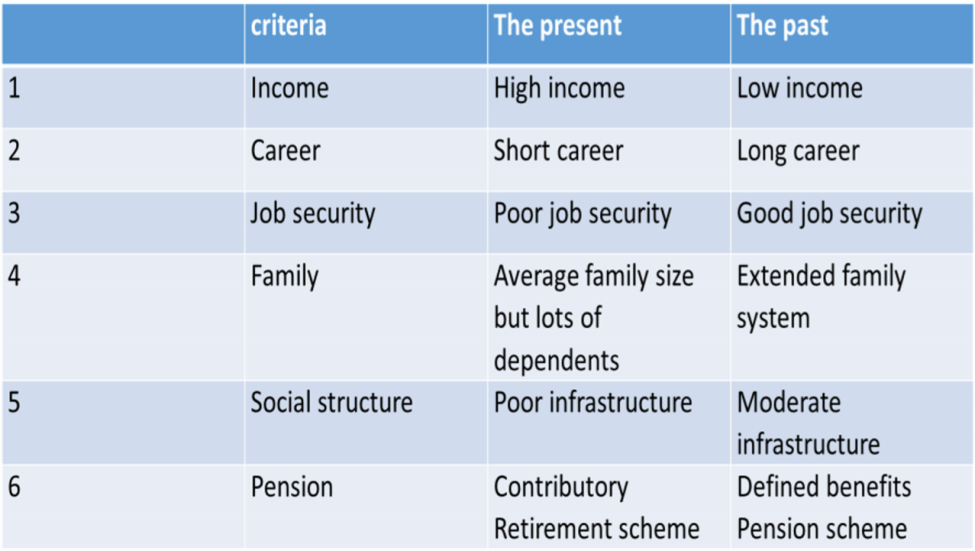

A comparison of yesterday and today’s Nigeria

ECONOMIC FACTORS THAT AFFECT THE INCOME OF A RETIREE

Inflation – Rising inflation increases general costs of goods and services. Better investment and new income is required.

Exchange rate – Because we are largely import dependent, a change in exchange rate also affects the general price level.

Interest rate – Stable interest rates means that long and medium term investments can be made with a clear picture of what future investment income could be.

General economic management – An economy that is well managed provides basic infrastructure and a conducive environment for trade, investment and general livelihood.

ACTIVITY 2A

Write out your expected income and expenditure patterns at retirement. How does a change in each of these economic factors affect it?

FUTURE OUTLOOK

A successful retirement begins with envisioning a rewarding healthy and responsible lifestyle. You must consider both your financial assets and liabilities that will fund your expected activities.

Travelling to far- flung destinations.

Indulging in my favorite hobbies.

Enjoying unhurried time with friends and family.

Devoting more time to volunteering

Starting my own business…

RETIREMENT REALITIES

Changing income sources – Retirement income used to come largely from pensions and gratuities. These days organizations are designing policies to reduce the gratuities they pay and pensions have been mismanaged both in the public and private sectors. Future retirees will depend more on savings and investments.

Economic changes – inflation etc. could reduce your purchasing power.

Healthcare – as you grow older, healthcare cost would likely increase.

Longer term care – we are living longer, so retirement lasts longer. Jobs are no longer stable, so retirement starts earlier.

Retirement activities – would largely be funded from your assets, savings, other investments and your pension plan. It is estimated that you would need at least 80% of your pre- retirement income to maintain your desired level of livelihood post- retirement

ACTIVITY 2B

Imagine what you would like to do during each season of your ideal year.

Visualize a day-to-day style of living that will motivate your mind, maintain your health, and build relationships within your community.

Where will your retirement income come from? List sources and projected volume.

How much will you need to maintain your lifestyle – list expenditure items. Consider your current annual fixed household expenses and current annual discretionary household expenses.