ATC

ATC

Retirement needs and how to plan ahead:

Start saving, keep saving, and stick to your goals

Know your retirement needs

Contribute to your employer’s retirement savings plan

Learn about your employer’s pension plan

Don’t touch your retirement savings

Budget for changes in your day-to-day spending after you retire

Clear your debts before you retire

Get advice and finalize your choice

Managing retirement benefits/income Retirement Benefits:

Gratuity

Pension

Defined benefit scheme

Defined contribution scheme

Savings and investments

Pension Fund Management

Pension funds are managed to provide post-retirement benefits to employees.

A pension plan is a retirement plan that requires an employer to make contributions into a pool of funds set aside for a worker's future benefit. The pool of funds is invested on the employees’ behalf, and the earnings on the investments generate income to the worker upon retirement.

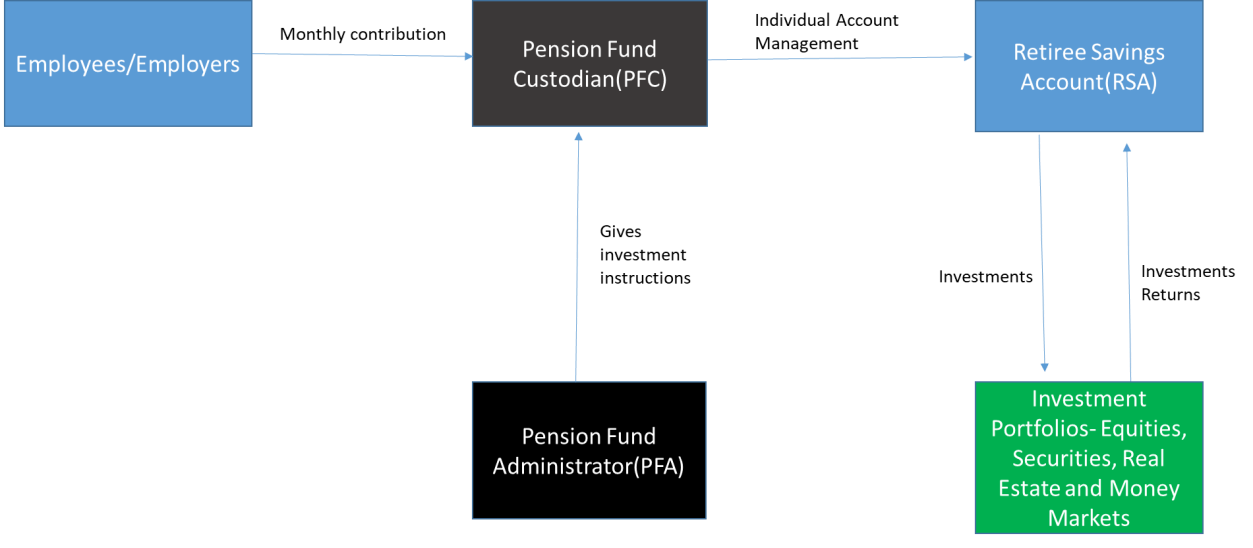

Some of the bodies involved in the management of Pension Funds are;

National Pension Commission (PENCOM)- which regulates and supervises pension matters

Pension Fund Administrators (PFAs). They are Private Limited Liability Companies licensed to manage pension funds under the Pension Act 2004.

Pension Fund Custodians (PFCs) They are banks licensed to hold the pension fund assets on behalf of the PFA

Pensions as a Major Source of Income

A pension is a fund into which a sum of money is added during an employee’s employment years, and from which payments are drawn to support his or her retirement from work in the form of periodic payments.

The major source of income for most retirees is public and private pension.

Having a pension plan is one of the most secure insurance policies for your future upon retirement, and it is important that when you are about to start a new job, you ensure that a pension plan is part of your package.

So, you might ask, what happens to your pension contributions when they are deducted? Do they just sit in the account until you retire and can withdraw them? The answer is no, the Pension Fund Administrator gives investment instructions to the Pension Fund Custodians on how to invest them in certain approved categories of investments e.g. government bonds, Treasury bills, Real estate, money markets and other securities as well as shares of public limited companies. This is strictly monitored by the Pension Fund Commission, with substantial fines and penalties for non-compliance.

Accessing Funding at Retirement

The process of documentation actually starts six months before you retire. For

FG employees, they have to go for the Bond verification exercise organized by PENCOM. Basically, this exercise is to enable PENCOM to consolidate their account and ensure their accrued rights are paid immediately once they retire. For Private sector employees, your PFA has to confirm that all contributions due to you have been made. This process is called ‘consolidation of account’. After this is done, the process of actual payment should take about 3 weeks.

Accessing Funding at Retirement having attained the age of 50 years:

A holder of a retirement savings account shall, upon retirement or attaining the age of 50 years, whichever is later, utilize the amount credited to his retirement savings for any of the below benefits

Withdrawal of a lump sum provided that the amount left after the withdrawal shall be sufficient to procure a programmed fund withdrawal or annuity for life

Programmed monthly or quarterly withdrawals calculated on the basis of life expectancy

Accessing Funding before 50 years of age following voluntary retirement or redundancy:

A holder may be allowed access to 25% of the Retirement Savings Account if he/she voluntarily retires, disengages or is disengaged from employment on the advise of a suitably qualified physician on account of mental or physical health, disability or at the age of 50 years in accordance of the terms of employment. This is on the condition that the withdrawal shall only be made after four months of such retirement and the employee does not secure another employment

HOW YOUR PENSION CONTRIBUTION FLOWS