ATC

ATC

Economic Factors That Affect Personal Finance

Inflation – Rising inflation increases general costs of goods and services. Better investment and new income is required.

Exchange rate – Because we are largely import dependent, a change in exchange rate also affects the general price level.

Interest rate – Stable interest rates mean that long and medium term investments can be made with a clear picture of what future investment income could be.

General economic management – An economy that is well managed provides basic infrastructure and a conducive environment for trade, investment and general better livelihood for all.

How do these factors affect your financial decisions?

Economic growth in the country: If a country is growing well, businesses do well. As a result, stock prices increase. On the other hand, interest rates and inflation remains moderate. When a country is in a down cycle, stock prices are relatively low and interest rates and inflation start to increase.

Political issues: When a country enjoys political stability, the economy prospers. The political party in power has an impact on the performance of stocks and other financial products.

Interest rates: Interest rates determine the rates at which businesses borrow and lend to the banking sector and other lending institutions. Usually, when business people want to borrow more money to grow their businesses, interest rates in the market increase.

Inflation: The rise in prices is broadly referred to as inflation. If inflation and interest rates are high, businesses are likely to show lower profits and therefore their prices on the stock exchange are likely to fall.

Inflation also has a direct impact on the way we plan for long term goals.

If inflation is high, we expect the cost of the goal in the distant future to be higher and we have to invest accordingly, and vice versa.

Global issues: Our economy is affected by many global issues. If prices of oil rise internationally, we face higher fuel prices too. Directly and indirectly this pushes inflation upwards.

Social factors: crime, poverty

What plans to make in order to avoid being affected by the change in an economy (whether good or bad)

Spending behavior

Provisioning for emergencies and risk management

Investments

Planning your finances

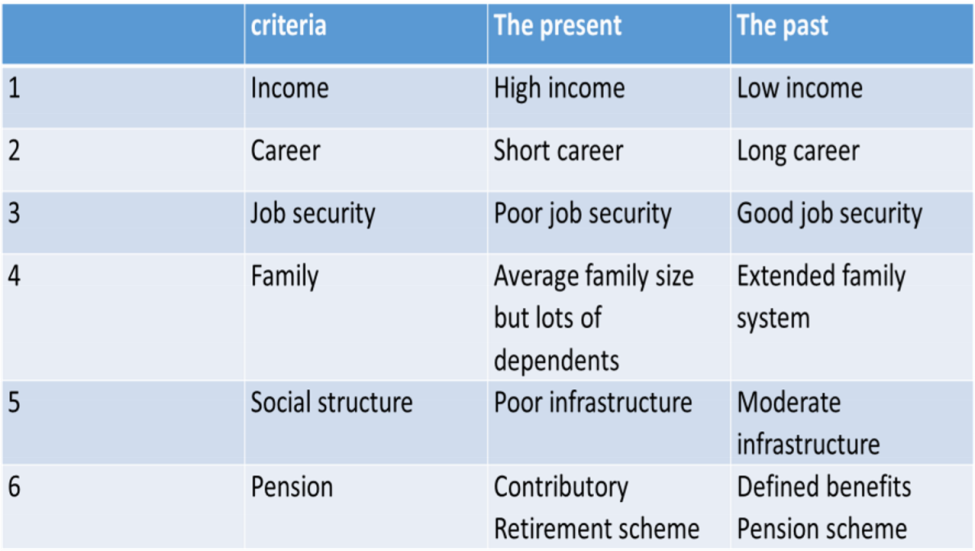

A comparison of yesterday and today’s Nigeria