ATC

ATC

Financial Management: is the process of planning, organizing, controlling and monitoring financial resources with a view to achieve one’s goals and objectives

The process includes four distinct steps, as follows:

Information gathering (i.e., life goals, assets, liabilities, cash inflows and outflows, investment preferences, etc.) and analysis

Plan development; aligning resources to short- and long-term goals

Plan implementation

Plan monitoring, periodic review and adjustment

Foundation principles of Finance

Organize Your Finances

Spend Less Than You Earn

Put Your Money to Work

Limit Debt to Income-Producing Assets

Continuously Educate Yourself

Understand Risk

Diversification Is Not Just for Investments

Maximize Your Employment Benefits

Comply with Tax obligations

Plan for the Unexpected (risk management)

Elements of Financial Management

Economic considerations

Insurance

Financial budgeting

Investments appraisal

Local and foreign obligations

Tax matters

Income management (Liquid assets-cash)

Retirement planning

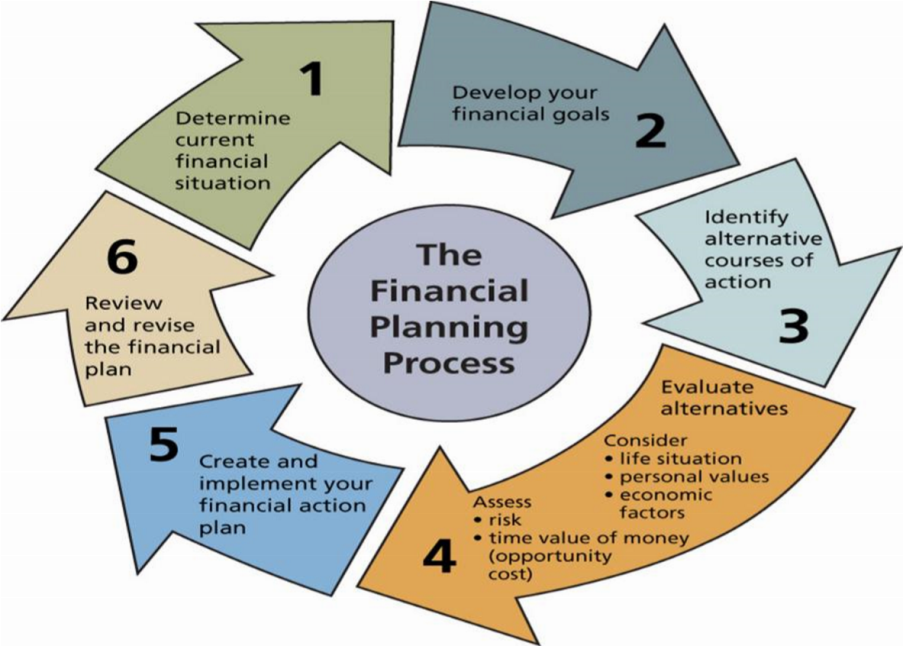

The Financial Planning Process

Benefits and impact of financial planning

Financial Planning helps you take a 'big picture' look at your financial position

It guides you to examine your current financial status and determine objectives.

It helps in devising a strategy or plan for how you can meet your goals given your current situation and future plans.

It also identifies weaknesses and recommends improvements.

It puts in place the risk management system to meet uncertainties of life through efficient Retirement Planning, Insurance Planning, Tax Planning and Estate planning

It helps you prepare for immediate and future needs or unexpected life events

How can we achieve Savings, reduce expenses, multiply Income Sources?

Tackle High-Interest Debt First

Cut Down Your Biggest Expenses

Start a Side Hustle (business)

Keep Your Budget Lean

Eliminate or reduce unhelpful social habits

Cost reduction